Ze bestaan sinds 2010 en het zijn er inmiddels wereldwijd meer dan 120: Social Impact Bonds (SIBs). Sinds onze zusterorganisatie Social Finance UK de eerste in het Engelse Peterborough lanceerde, hebben meer dan 20 landen het instrument ingezet. Met meer dan 50 SIBs is het Verenigd Koninkrijk nog steeds koploper. Op ééntje na (in Wales) lanceerden ze allemaal in Engeland. Maar dat betekent niet dat er geen spannende ontwikkelingen omtrent social finance in Schotland zijn. Integendeel! De afgelopen jaren is daar een nieuw innovatief model ontwikkeld en gepilot: Social Bridging Finance.

Wat is Social Bridging Finance ?

The Robertson Trust ontwikkelde het model: een onafhankelijke Schotse financier die zich richt op het verbeteren van de kwaliteit van leven en het benutten van de talenten in Schotland.

The Robertson Trust beschrijft Social Bridging Finance als een model voor subsidieverlening dat het leveren van maatschappelijke diensten ondersteunt. Ook waarborgt het de duurzaamheid van bewezen succesvolle maatschappelijke diensten door een contract met de publieke sector op te stellen.

Het werkt als volgt:

Ontwerp en contracteren

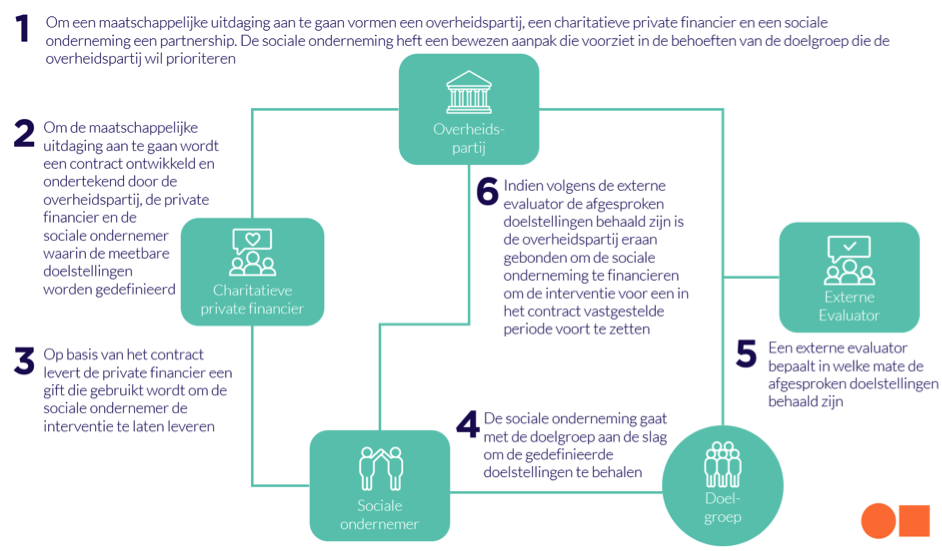

Een overheidspartij, een private charitatieve financier en een sociale ondernemer vormen een partnership voor het aangaan van een maatschappelijke uitdaging waarvoor de overheidspartij op de lange termijn preventieve diensten wil financieren. De partners maken vooraf afspraken over doelstellingen en meetbare uitkomsten. De partners tekenen een contract die de overheidspartij committereert om, indien de afgesproken doelstellingen worden behaald, de sociale ondernemer te betalen. Dit zodat de interventie een bepaalde periode kan worden voortgezet.

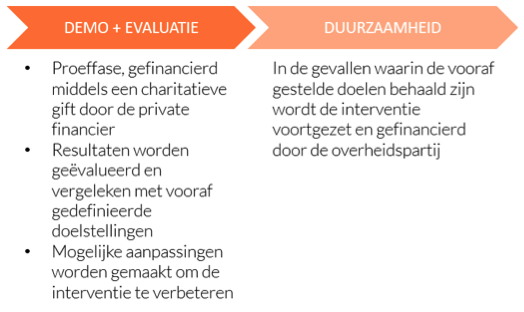

Demo

Na een opzetfase levert de sociale onderneming de interventie gedurende een vooraf afgesproken periode, bijvoorbeeld twee of drie jaar. Dit is de demofase en de private charitatieve financier betaalt deze. Voor de best mogelijke maatschappelijke resultaten kunnen partners in deze periode aanpassingen maken in de manier waarop de interventie wordt uitgevoerd.

Evaluatie

Het partnership laat tijdens de demofase een evaluatie van de resultaten uitvoeren. Aan de hand van tussentijdse rapporten kan het partnership de interventie indien nodig aanpassen. Ook geeft het tegen het einde van de demofase een bindend oordeel over het al dan niet behalen van de afgesproken doelstellingen.

Duurzaamheid

Als de externe evaluator heeft vastgesteld dat de doelen zijn behaald, bepaalt het contract hoe lang de overheidspartij een subsidie verstrekt voor het voortzetten van de interventie. Zijn de doelstellingen niet behaald, zorgen alle partners ervoor dat ze hier lering uit trekken en gaat ieder zijn weg.

Figuur 1: De twee fases waarin de sociale ondernemer de interventie levert

Figuur 2: Schematische weergave van Social Bridging Finance

SBF versus SIB

In de eerste plaats vertonen SBF en SIBs veel overeenkomsten:

- beide zijn partnerships tussen overheidspartijen, private financiers en uitvoerders van maatschappelijke interventies, zoals sociaal ondernemers

- beide vereisen meetbare uitkomsten voor het maatschappelijk vraagstuk waarover alle partners met elkaar in overeenstemming zijn

- bij beide instrumenten hangt de betaling van de overheid af van de mate waarin resultaten worden behaald

- beide lenen zich voor het vervangen van reactieve uitgaven voor maatschappelijke uitdagingen voor preventieve uitgaven

- beide kunnen worden gebruikt om bewezen aanpakken voor maatschappelijke uitdagingen op te schalen

Maar er is ook een aantal significante verschillen:

- bij SIBs is de private financier een investeerder, die winst kan maken op basis van de resultaten gemeten door de evaluator, terwijl bij SBF de private financier geen betalingen ontvangt. Ik verwacht dat het per private financier verschilt of ze dit als een voordeel of nadeel van SBF zien. Een potentieel financieel rendement kan een vereiste zijn voor sommige private financiers, terwijl er ook private financiers zijn voor wanneer een rendement niet past bij de huidige structuur of wensen.

- bij SIBs betaalt de overheidspartij uit voor de daadwerkelijk behaalde resultaten (waarbij ze de private financier betalen), terwijl de overheidspartij bij SBF niet hoeft te betalen voor de resultaten die tijdens de demofase – gefinancierd door de private financier- zijn behaal. Ik verwacht dat dit SBF aantrekkelijker zal maken voor de publieke sector dan SIBs, omdat het betekent dat er een periode is waarin een maatschappelijke interventie geleverd wordt zonder kosten voor de overheid. Een risico kan zijn dat dit de wens voor goede resultaatmeting kan verzwakken (bijvoorbeeld met benchmarking) om de daadwerkelijke toegevoegde waarde van de interventie te weten.

- Bij SIBs bepaalt het contract de financiering van de interventie gedurende de SIB-fase, die vergelijkbaar is met de demofase van SBF, terwijl de overheidspartij zich bij SBF vastlegt om na deze demofase de interventie voor een afgesproken periode voort te zetten en te financieren indien deze succesvol is gebleken. Het grootste voordeel dat ik hierbij verwacht is dat het een periode faciliteert waarin succesvolle interventies gefinancierd worden middels de standaard structuur van de overheidspartij,. Dit kan het eenvoudiger maken om de interventie langer voort te zetten. Bij SIBs moet de overheidspartij los van de SIB uitzoeken of en hoe ze een succesvolle interventie kunnen voortzetten.

- de opzet en contracten kunnen voor SBF simpeler zijn dan voor een SIB. Een van de kritieken op SIBs is dat de opzet en het onderliggende contract vrij complex kunnen zijn. Met een SBF hoeven we de maatschappelijke uitkomsten niet financieel te kwantificeren. Voor SIBs is dit normaliter een cruciaal en lastig onderdeel van het proces en de contracten. Dat er geen afspraken over uitbetaling door de overheidspartij aan de private financier (afhankelijk van verschillende meetbare uitkomsten) hoeven worden vastgelegd, maakt de contracten ook significant minder ingewikkeld.

Conclusie

Persoonlijk ben ik zeer enthousiast over SBF. Mijn passie voor SIBs is er niet minder om, maar ik zie zeker voordelen in de SBF-aanpak die ik graag middels pilots in Nederland zou testen. Social Finance NL kan overheidspartijen ondersteunen bij het opzetten van een SBF-partnership voor de maatschappelijke uitdagingen die zij willen aanpakken. Het belangrijkste voordeel van SBF vind ik dat als de interventie succesvol gebleken is, de betrokken partners en de doelgroep verzekerd zijn van voortzetting van de interventie. Maar uiteindelijk gaat het natuurlijk niet om het kiezen van een favoriet financieringsmodel. Ons belangrijkste doel is het bereiken van positieve sociale impact. Zowel SBF als SIBs zijn een middel om dit doel te bereiken, ieder met eigen voordelen binnen verschillende scenario’s.

Eén ding is zeker, met Engeland als de founding father van SIBs en Schotland als het moederland van SBFs heeft het Verenigd Koninkrijk zichzelf wederom bewezen als koploper in de wereld van social finance.

Ik hoor heel graag van jullie als overheidspartijen en private investeerders hoe zij denken over Social Bridging Finance. Is het een aantrekkelijk instrument? En is er een bepaalde maatschappelijke uitdaging die jullie zouden willen addresseren met hulp van dit instrument? Ik ga graag met jullie in gesprek en ben bereikbaar via sabine.oudt@socfin.nl.