Health Impact Bond on Fall Prevention

New financing structure to reduce fall incidents

Annually, nearly 100,000 senior individuals end up in the emergency room due to a fall incident, and over 5,000 fatalities occur as a result of such incidents. These figures are estimated to cost €1.2 billion, though 28% of these incidents are preventable by investing in fall prevention measures. However, this requires a different approach to collaboration and investment. Municipalities are responsible for prevention, while the financial costs of fall incidents are covered by health insurance companies. By establishing a Health Impact Bond, we offer a solution that benefits seniors, municipalities, and health insurance companies. Under the title ‘Stevig Staan’ (Stand Firmly), the Health Impact Bond aims to reduce fall incidents among 2,500 seniors in Noord-Limburg by offering a variety of training courses.

The Health Impact Bond ‘Stevig Staan’

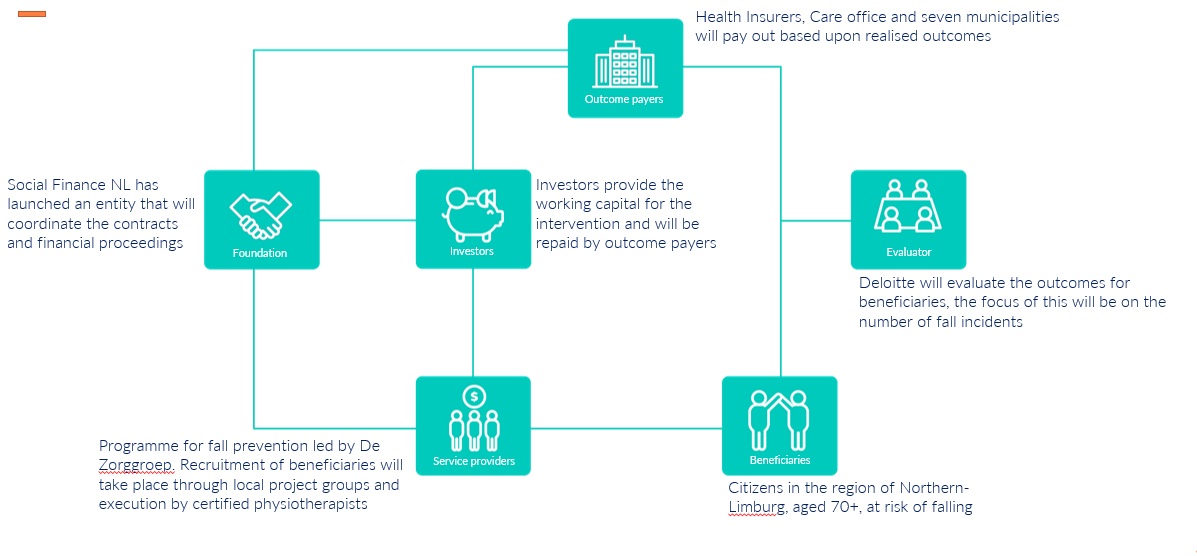

A Health Impact Bond is a financial instrument where (social) investors provide capital for an intervention. In this impact bond, BNP Paribas, Rabobank, Bridges, and also individuals through Oneplanetcrowd invested capital in a programme aimed at senior fall prevention. The two courses offered in this programme have previously shown to reduce fall incidents among participants. In the “Stevig Staan” Health Impact Bond, the number of fall incidents among participating seniors will be measured over the course of two years. Positive results from the intervention lead to financial savings for health insurance companies, care offices (nursing home care), and municipalities (home care). These benefits collectively exceed the costs of the intervention itself, creating a socially positive business case. The seven participating municipalities in Noord-Limburg, health insurance companies VGZ and CZ, and the VGZ Care Office are repaying these benefits to the investors.

The fall prevention programme

Through a public-private partnership, municipalities, health insurers, De Zorggroep, and Social Finance NL are financing and organizing a fall prevention programme for a total of 2,500 senior individuals at increased risk of falling in the region of Noord-Limburg. Over a 5-year period (plus 3 months), with 500 participants annually, our aim is to prevent 3,940 fall incidents among participants.

The programme is being implemented under the leadership of De Zorggroep. Together with local physiotherapists, healthcare professionals, and social workers, participants are being recruited and offered a fall prevention exercise program. The approach of the programme consists of the following steps:

- Recruitment: attracting seniors through vitality meetings, the involvement of healthcare professionals, and an extensive communication campaign.

- Screening: approximately 1,480 seniors per year will undergo screening by physiotherapists and other healthcare professionals to assess their risk of falling and vulnerability.

- Intervention: seniors identified with an increased risk of falling are advised to participate in one of two interventions: “Falling: a Thing of the Past” or “In Balance”. These interventions are conducted by qualified physiotherapists and exercise instructors. Other seniors are guided towards alternative offerings (outside of the Health Impact Bond).

In January 2023, the first participants began the programme. We will provide updates on the programme’s progress on our website and via our social media.